Determination of the National Average Wage Index for 2020 wage data we tabulated. For example if a fund has an expense ratio of 100 and the fund has a return before expenses of 1000 the net return to the investor is 900 1000 - 100.

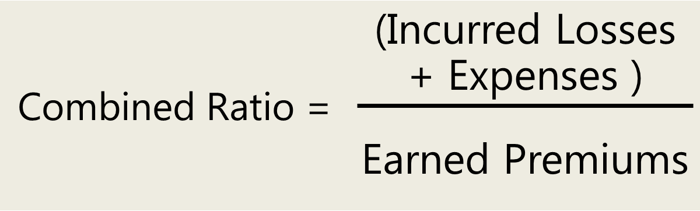

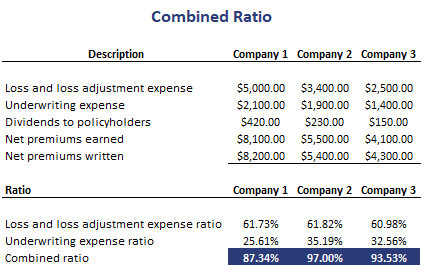

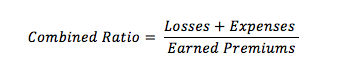

Insurance Industry Basics Combined Ratio The Motley Fool

The lower the average expense ratio for all US-listed ETFs in an industry the higher the rank.

. Housing Expense Ratio. Car Insurance. This ratio is also known as the Net Interest Margin NIM.

We apply a formula to this average to compute the primary insurance amount. AS OF 331. The expense ratio is a measure of what it costs an investment company to operate a mutual fund.

The PIA is the basis for the benefits that are paid to an individual. Let us understand the expense ratio meaning with an expense ratio example assuming your mutual fund schemes expense ratio is 125. The average renters insurance premium fell 06 percent in 2018 marking the fourth consecutive annual decline.

Renters insurance premiums fell 27 percent in 2017. Social Security benefits are typically computed using average indexed monthly earnings This average summarizes up to 35 years of a workers indexed earnings. A ratio comparing housing expenses to before-tax income that is used by lenders to qualify borrowers for a mortgage.

If a site is worth the extra expense increased income generated at. Cost of production concerns the sellers expenses eg manufacturing expense in producing the. Excluded from private industry are the self-employed private household workers and the agricultural sector.

That bodes well for his cash flow and his personal goals. Best Car Insurance. So if the average rate of profit return on capital investment is 22 then prices would reflect cost-of-production plus 22.

If your investment in this fund is Rs 100000 and assuming your investment value grows to Rs 100500 and 100125 on two subsequent days this is how much expense ratio you pay on each day-. The housing expense measure includes mortgage principal. Formulas for a primary insurance amount and maximum family benefits.

Low expenses can translate to higher returns. Average annual total returns smooth out variation in performance. An expense ratio is determined through an annual calculation where a funds.

The wage data are based on wages subject to Federal income taxes and contributions to deferred compensation plans. For passively managed funds the average expense ratio was 013 in 2019. This website is produced and published at US.

Net Interest Income TE to Average Earnings Assets Ratio. Rather for Marx price equals the cost of production capital-cost and labor-costs plus the average rate of profit. 283 Net commissions and brokerage expenses incurred.

And ETFs do not have 12b-1 fees. The Asset Management Companies can charge an additional 30 bps of Total Expense Ratio if the recent inflows from cities other than that listed as the top 15 reach up to 15 of the schemes Assets Under Management AUM or 30 of the gross inflows in the mutual fund scheme. For example retailers should target a base rental rate that is no more than 5 to 10 of gross annual sales where a law firm may find a rent to revenue ratio of 15 acceptable.

The ratio is comprised of annualized total interest income on a TEbasis less total interest expense divided by average earnings assets. Analyze the Fund Fidelity Select Insurance Portfolio having Symbol FSPCX for type mutual-funds and perform research on other mutual funds. Expenses for a mutual fund are taken from the funds assets before the investors receive their net return.

They are not the same as actual year-by-year results. The ECEC covers the civilian economy which includes data from both private industry and state and local government. Provides the average employer cost for wages and salaries as well as benefits per hour worked.

123 Taxes licenses and fees. This ratio indicates how well management employed the earning asset base. That said according to Morningstar the average ETF expense ratio in 2016 was 023 compared with the average expense ratio of 073 for index mutual funds and 145 for actively managed mutual funds.

His accounts receivable turnover ratio is 10 which means that the average accounts receivable are collected in 365 days. Insurance and all other industries are ranked based on their AUM-weighted average expense ratios for all the US-listed ETFs that are classified by ETF Database as being mostly exposed to those respective industries. Blanchard is a dentist who accepts insurance payments from a limited number of insurers and cash payments from patients not covered by those insurers.

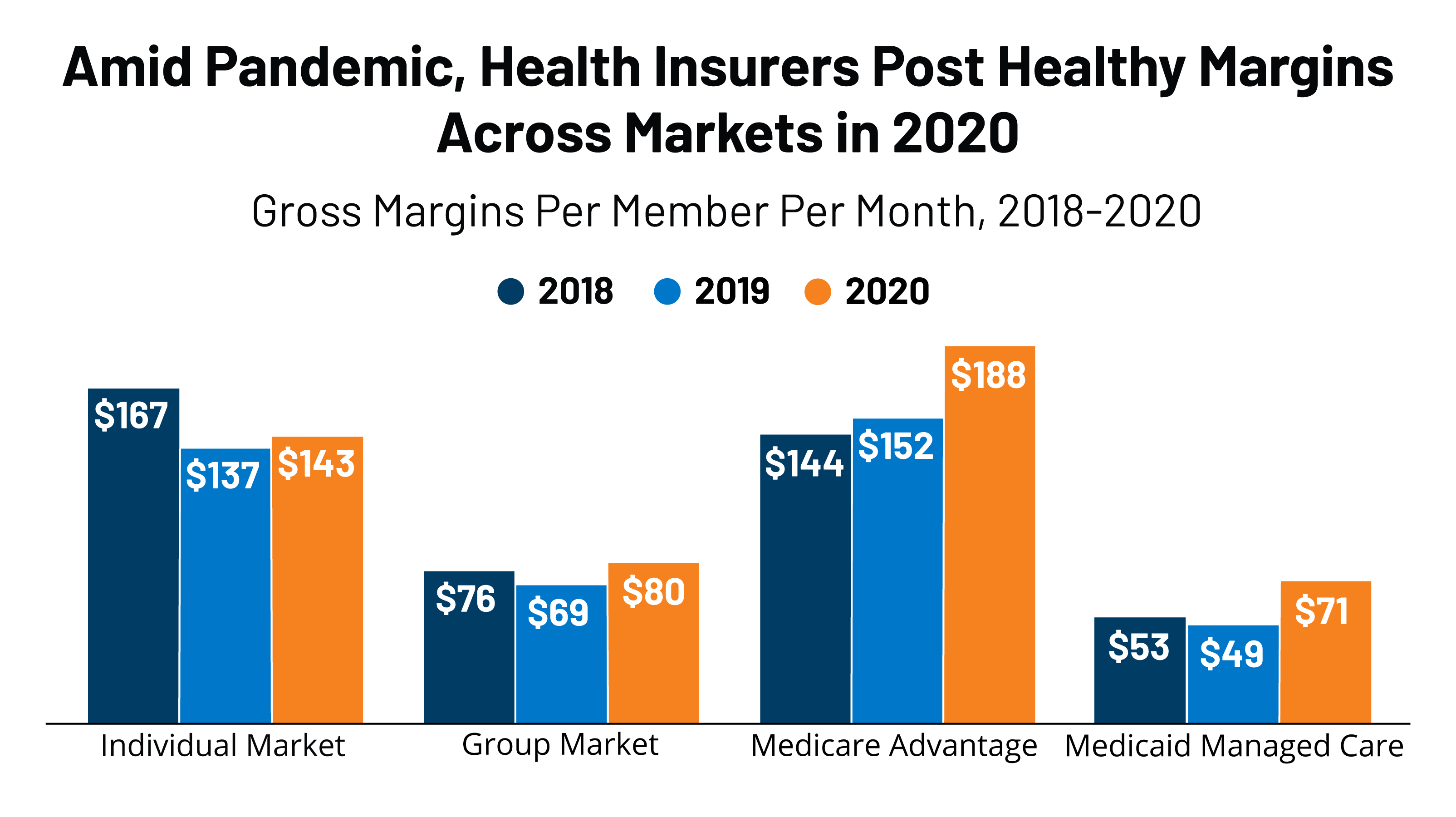

Among actively managed funds the average expense ratio in 2019 was 066. This rent to sales ratio will vary from 2 to 20 depending on the type of business you are in. As of 2007 the average US medical loss ratio for private insurers was 81 a 19 profit and expense ratio.

In the late 1990s loss ratios for health insurance known as the medical loss ratio or MLR ranged from 60 to 110 40 profits to 10 losses.

What Is An Expense Ratio Why It S Important How To Gauge It

Combined Ratio Breaking Down Finance

Vanguard Etf Mutual Fund Expense Ratio Drops Updated May 2022 My Money Blog

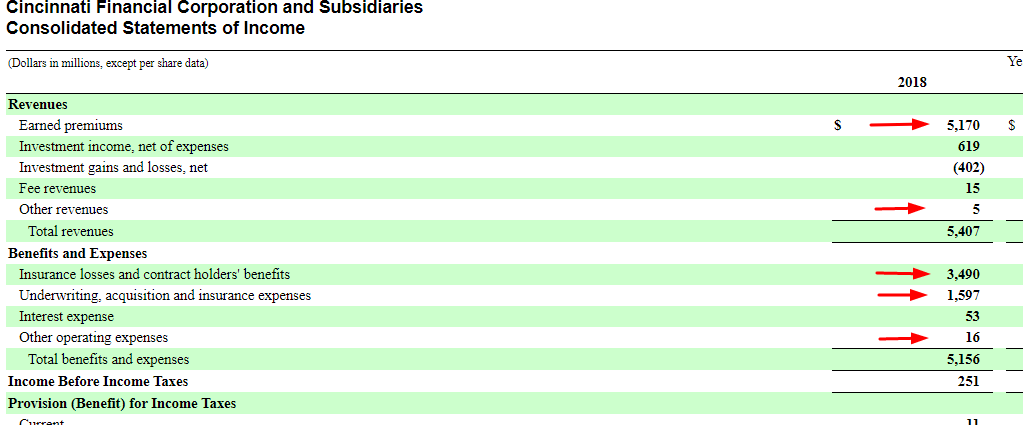

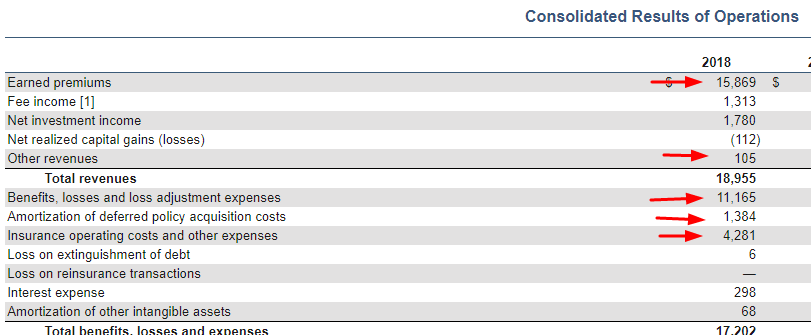

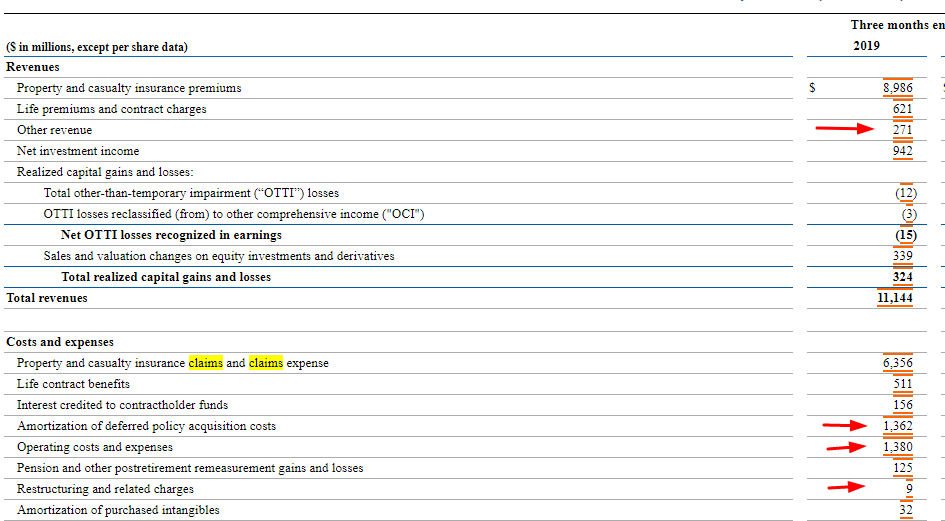

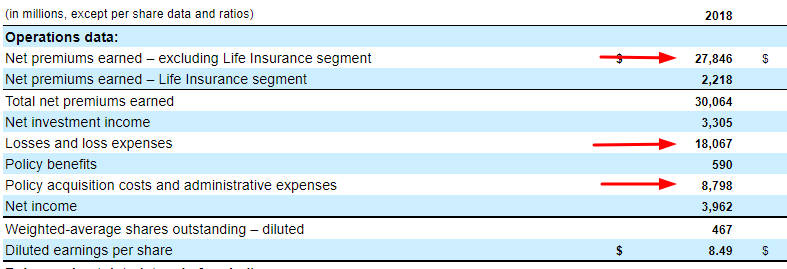

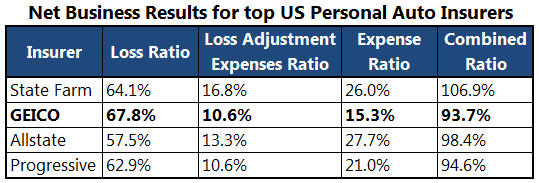

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

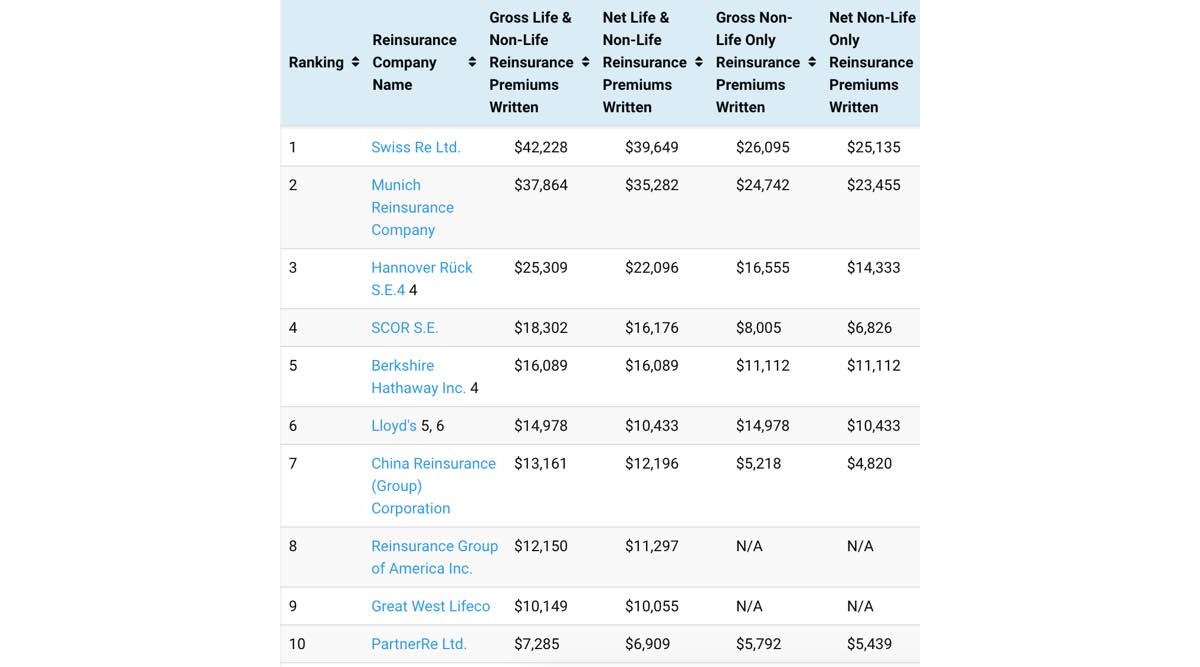

Average Combined Ratio Of The World S Top Reinsurers Declined In 2019 Reinsurance News

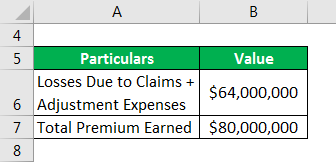

Loss Ratio Formula Calculator Example With Excel Template

Health Insurer Financial Performance In 2020 Kff

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

5 Metrics To Evaluate Life Insurance Business Mint

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

What Drives Insurance Operating Costs Mckinsey

What Are Expense Ratios How Do They Work Nextadvisor With Time

What Is Combined Ratio The Motley Fool

Underwriting Expense Ratio Of U S P C Insurance 2015 Statista

Loss Ratio Formula Calculator Example With Excel Template

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

What Is An Expense Ratio And What Does It Mean For You Thestreet

Insurance Industry Basics Combined Ratio The Motley Fool

2020 Insurance Year In Review And The Impact Of Covid 19 Expert Commentary Irmi Com